On August 23, 2023, the U.S. Securities and Exchange Commission (SEC) adopted new and amended rules under the Investment Advisers Act of 1940, as amended (the Advisers Act), to address what it perceives as certain conflicts of interest and threats to investor protection pervasive in the private funds industry (the Private Fund Adviser Rules).1 In a recent Client Alert, we discussed the Private Fund Adviser Rules, including Rule 211(h)(2)-1 (the Restricted Activities Rule), which will limit the ability of advisers to private funds regardless of whether they are registered with the SEC (private fund advisers) to engage in certain enumerated activities. This Client Alert serves to more fully explain the Restricted Activities Rule and offer practical guidance to private fund advisers on how to prepare to comply with its requirements.

Overview of the Restricted Activities Rule

The SEC had initially proposed to outright prohibit private fund advisers from engaging in a number of enumerated activities that the SEC had characterized as problematic. But after considering comments from throughout the industry, the SEC retreated (at least slightly) from some of these prohibitions and opted instead to permit these practices (described below) subject to new disclosure and consent requirements. The restricted activities covered by the rule can be categorized as either (i) prohibited unless disclosed to the fund’s investors or (ii) prohibited unless consented to by the fund’s investors. It remains to be seen whether the notice and consent requirements will be sufficiently chilling to effectively prohibit these practices irrespective of the SEC’s final rulemaking. Importantly, the Restricted Activities Rule’s notice and consent requirements do not apply (x) to advisers with respect to securitized asset funds they advise or (y) to offshore advisers with respect to offshore private funds they advise.

Restricted Activities Subject to Disclosure

Charging Regulatory, Compliance, or Examination Fees and Expenses

The Restricted Activities Rule will prohibit private fund advisers from charging to their private fund clients (i) regulatory or compliance fees and expenses or (ii) fees and expenses associated with a governmental or regulatory examination of the adviser (or its related persons) unless the adviser distributes written notice of any such fees and expenses and the amounts thereof to the fund’s investors. The required notice disclosing such charge must be distributed within 45 days after the end of the fiscal quarter in which the charge is incurred. The SEC reasons that charges for these compliance-related services may constitute a compensation scheme benefiting advisers at the expense of the fund, especially when the adviser already charges a management fee. As mentioned above, the rule is less severe than the proposed version, which purported to prohibit advisers from charging regulatory and compliance fees and expenses altogether.

Reducing Adviser Clawbacks for Taxes

The Restricted Activities Rule will prohibit private fund advisers from reducing the amount of any adviser clawback by actual, potential, or hypothetical taxes applicable to the adviser (or its related persons) unless the adviser distributes a written notice of the reduction to the fund’s investors. The required notice must set forth the aggregate amount of the clawback both before and after the reduction and be distributed within 45 days after the end of the fiscal quarter in which the clawback occurs. The notice requirement is intended to address the SEC’s concern that by allocating to the client the risk of a tax liability otherwise attributable to the adviser, the adviser would be placing its own interests above those of the fund’s investors. Again, in this instance, the rule does not prohibit this practice outright as the SEC had initially proposed.

Charging Portfolio Investment Fees and Expenses on a Non-Pro Rata Basis

The Restricted Activities Rule will prohibit private fund advisers from charging to their private fund clients any fees and expenses related to a portfolio investment on a non-pro rata basis when multiple private funds advised by the adviser are investing in the same portfolio investment unless (i) the charge is “fair and equitable” under the circumstances and (ii) prior to doing so, the adviser distributes to each of the fund’s investors a written notice of the charge and a description (effectively a justification) of how the allocation of fees or expenses is fair and equitable. The adopting release does not set forth a methodology by which an allocation is deemed to be fair and equitable but instead states that determination will depend on factors relevant for the specific expenses. The rule also does not define the term “pro rata,” and the direction in the adopting release recognizes there may be multiple methods to determine pro rata allocations, though it does acknowledge that advisers historically make pro rata allocations based on ownership percentages. The failure to provide a definition of pro rata is likely to result in some ambiguity in the market and give advisers some leeway in establishing their methodologies and calculations of pro rata and the corresponding determinations of whether or not an allocation is fair and equitable. The notice requirement here is intended to address the SEC’s concern that advisers may have economic incentives to charge some clients more than others and thus place their own interests above those of some investors. Again, in this instance, the rule does not prohibit this practice outright as the SEC had initially proposed.

Restricted Activities Subject to Notice and Consent

Charging Investigation Fees and Expenses to the Fund

The Restricted Activities Rule will prohibit private fund advisers from charging to their private fund clients fees and expenses associated with governmental or regulatory investigations of the adviser or its related persons unless the adviser seeks consent from the private fund’s investors and actually obtains written consent from a majority in interest of investors who are not related persons of the adviser. However, in no event may the adviser charge fees and expenses related to an investigation that results in sanctions for violating the Advisers Act or its rules, as those charges will be prohibited. The SEC is concerned that such charges may constitute a compensation scheme and provide an incentive for advisers to place their own interests ahead of those of the fund’s investors. However, the rule does not prohibit such charges outright as the SEC had initially proposed.

Borrowing From the Fund

The Restricted Activities Rule will prohibit private fund advisers from borrowing assets or taking out any loans or extensions of credit from a private fund client unless the adviser distributes a written description of the material terms of the borrowing to the fund’s investors, seeks their consent, and actually obtains written consent from a majority in interest of investors who are not related persons of the adviser. The new requirement is intended to address the conflict of interest associated with the adviser’s presence on both sides of the loan transaction – acting as a borrower setting the terms of its own loan. However, the rule does not prohibit borrowing outright as the SEC had initially proposed.

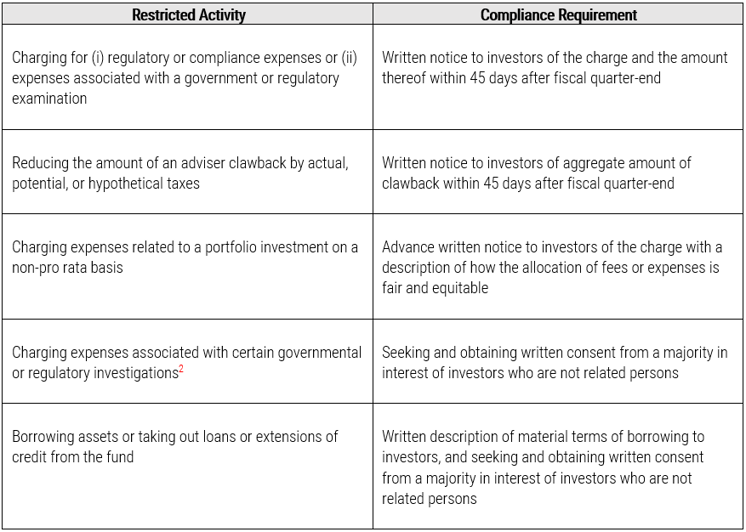

The following chart summarizes the restricted activities covered by the rule and what advisers must do if they wish to engage in such activities.

Related Recordkeeping Requirements

The SEC also adopted companion amendments to Rule 204-2 under the Advisers Act. These amendments will require SEC-registered investment advisers to private funds to retain copies of all notifications, consents, and other documents distributed to or received from private fund investors pursuant to the Restricted Activities Rule. Advisers must also maintain records of each addressee and the corresponding dates upon which the advisers made the required distributions.

Legacy Status

The SEC has granted legacy status to the restricted activities with consent requirements discussed above (i.e., charging for investigation-related expenses—other than those related to an investigation resulting in a sanction for violating the Advisers Act or its rules—and borrowing assets from the fund). Under the rule, advisers are not required to seek and obtain consent from investors to engage in these activities if (i) the activity is set forth in an agreement governing the fund (e.g., operating or organizational agreements, subscription agreements, or side letters) or governing the borrowing (e.g., promissory notes or credit agreements) that was entered into before the compliance date, (ii) the fund has already commenced operations at the time of the compliance date, and (iii) the rule would require the parties to amend the agreement. The adopting release provides that “commencing operations” means any bona fide activity directed toward operating the fund, such as investment, fundraising, or operational activity. Importantly, legacy status eliminates only the consent requirement and not the notice requirement under the rule. As a result, advisers must still provide the above-described notices to investors as of the compliance date, including with respect to existing practices that are already set forth in existing fund documents. Advisers will be well advised to consider how the disclosure of these practices may affect investor sentiment with respect to the practices to which they apply.

Our Thoughts

Private fund advisers should review their current fund documents to determine whether they should be amended to reflect the notice and consent requirements of the Restricted Activities Rule. In addition, advisers should update their compliance policies and procedures to reflect the new rule so that the requirements are properly stated, the notice and consent requirements are appropriately calendared, and the recordkeeping requirements are properly updated. Advisers will need to consider how they capture, disclose, and document the items and calculate the expenses implicated by the new rule (i.e., regulatory expenses, clawback amounts and taxes, portfolio investment expenses, investigation expenses, and loans). In all cases, advisers must be conscientious about ensuring that the notices they distribute meet the technical requirements of the new rule and are sufficiently fulsome to give rise to informed consent where required. For the avoidance of doubt, the new notice and consent requirements are incremental to the adviser’s existing obligations, so in addition to providing the new disclosures required by the rule, advisers should be conscientious about ensuring that all expenses referenced in the new disclosures are explicitly authorized by and appropriately documented in the funds’ governing documents before charging those expenses to the funds.

As discussed above, in cases where consent is required, the adviser must obtain written consent from a majority in interest of the investors in the fund who are not related persons of the adviser. The SEC’s adopting release indicates that seeking and obtaining approval from fund governance bodies such as limited partner advisory committees, advisory boards, or boards of directors will not satisfy this requirement, implying that each investor must be solicited individually. The text of the adopting release also implies that, with respect to charging investigation fees or expenses, consent must be obtained separately for each investigation. Similarly, with respect to fund borrowings, the rule provides that consent solicitations must include a written description of the material terms of each borrowing. These details indicate that an adviser would not satisfy the consent requirements by generally setting forth in the fund documents the adviser’s intention to charge for investigation expenses or borrow from the fund in the future, effectively seeking (and receiving) broad consent from investors in advance. Instead, it appears the solicitations and consents must occur in real time if and when such investigations occur, or loans are proposed to be made, during the life of the fund. Moreover, while the rule imposes a requirement to obtain written consent, the SEC does not specify (and it remains an open question as to) whether affirmative, as opposed to negative, consent will be required.

As mentioned elsewhere in this article, while the new rule does not give rise to outright prohibitions, the rule is likely to chill these practices in any event, as investors have little incentive to consent to absorbing these charges or permitting these loans once the rule goes into effect. We will be watching closely to observe the market practices that evolve as a result of the rule. It is possible that outcomes and practices here may vary by adviser, as larger, more established advisers may be given broad leeway by investors to engage in certain of these practices, while smaller, less-established advisers may be unable to secure the required consents.

Additional Rulemaking by Enforcement

Advisers should also be mindful of the SEC’s commentary with respect to two other adviser practices not covered by the Restricted Activities Rule. As we discussed in our earlier Client Alert summarizing the SEC’s proposed version of the rule, the SEC had initially proposed to prohibit, in addition to the practices described above, (i) charging portfolio investments for monitoring, servicing, or consulting expenses with respect to services the adviser does not ultimately provide and (ii) seeking reimbursement, indemnification, exculpation, or a limitation of its liability from the private fund for breaches of the adviser’s fiduciary duty, willful misfeasance, bad faith, negligence, or recklessness in providing services to the fund.

Though the SEC did not restrict or subject these practices to the notice and consent requirements in the final rule, it is apparent that the SEC still views these practices as (at least potentially) problematic. The adopting release reiterates that these practices often cut against the adviser’s fiduciary duty to clients and could also violate the Advisers Act’s antifraud provisions. Moreover, the SEC hints that it already has sufficient authority to prosecute such practices via enforcement actions and thus their inclusion in the Restricted Activities Rule is unnecessary. Although, as discussed above, while the Restricted Activities Rule will not apply to advisers with respect to securitized asset funds or to offshore advisers with respect to offshore private funds, the practices discussed in the paragraph immediately above may nevertheless be prosecutable as failures to comply with the advisers’ fiduciary duty. As a result, all advisers would also be well advised to consider the SEC’s view of these practices as they review their fund documents and compliance policies and procedures.

Next Steps

The SEC is adopting staggered compliance dates for the Restricted Activities Rule that provide for the following transition periods. Advisers with $1.5 billion or more in private fund assets under management must comply within 12 months after publication of the Restricted Activities Rule in the Federal Register, while advisers with less than $1.5 billion in private fund assets under management must comply within 18 months after publication. We encourage all advisers to undertake a review of their fund documents and compliance policies and procedures in order to comply with the applicable disclosure and consent requirements within the relevant transition periods.

Please contact one of the listed authors of this Client Alert or your regular Lowenstein Sandler contact if you have any questions regarding this rule.

1 The SEC’s adopting release setting forth the Private Fund Adviser Rules is available here.

2 As stated above, advisers may not, irrespective of notice to and consent from investors, charge fees or expenses related to an investigation resulting in a sanction for violations of the Advisers Act or the rules thereunder.