On May 25, 2022, the Securities and Exchange Commission (SEC) proposed rules to (i) enhance and standardize the disclosures of Advisers and Registered Funds, related to the incorporation of environmental, social, and governance (ESG) factors into their investment strategies and (ii) expand the current Names Rule to further prevent the misleading use of names by Registered Funds (the Proposed Rules).3

Background

ESG Disclosures

Interest in ESG-based investment strategies has rapidly accelerated in recent years, attracting significant investor inflows to ESG-related investment products offered by Advisers managing assets for private investment funds, institutional and individual clients, as well as Registered Funds. In response, Advisers and Registered Funds have created and marketed products and strategies that consider ESG factors in their investment selection and portfolio management processes. From the SEC’s perspective, investors seeking to participate in ESG-based investing are not furnished with consistent, comparable, and reliable information concerning the investments and, in particular, the significance of ESG considerations associated with such investments in the existing disclosures made by Advisers and Registered Funds.4 Because ESG can reflect vague, foggy and expansive topics, the SEC believes it is becoming difficult for investors to assess which ESG factors are being considered and how Advisers and Registered Funds analyze, select and manage investments to achieve ESG-oriented strategies. To that end, the Proposed Rules state that there is risk that the incorporation of ESG considerations by Advisers and Registered Funds is not sufficiently aligned with investor expectations, and that Advisers and Registered Funds may exaggerate ESG strategies in their marketing materials. Accordingly, the SEC has put forth the Proposed Rules with the aim of establishing a consistent and comparable framework of disclosure in the Form ADVs of Advisers and in prospectuses and annual shareholder reports of Registered Funds.

Names Rule

In 2001, the SEC adopted rule 35d-1 (Names Rule) under the Investment Company Act of 1940, as amended which requires a Registered Fund with a name suggesting that it focuses on a particular type of investment to invest at least 80 percent of its assets in that type of investment. Examples of Registered Funds subject to the current Names Rule are those with names associated with certain types of securities, industries, geographies and tax-exempt status. The SEC adopted the current version of the Names Rule to address names of Registered Funds that were deceptive and likely to mislead investors. The SEC has put forth the Proposed Rules to expand the scope of the Names Rule to apply to any Registered Fund name that suggests a focus in investments or issuers with particular characteristics.

Proposed ESG Disclosure Requirements for Advisers

The Proposed Rules would also amend Form ADV Part 1A to expand information collected about separately managed account clients and private funds managed by an Adviser, as follows:

- With respect to Item 5.K. and the corresponding sections of Schedule D, an Adviser would need to address whether it considers ESG factors as part of one or more significant strategies in the advisory services it provides to separately managed account clients, including in its selection of other investment advisers and/or as part of its advisory services, when requested by such clients. If so, the Adviser would be required to indicate whether it employs an ESG-integration or ESG-focused approach for such significant strategies, and if ESG-focused, whether it also employs an ESG-impact approach.

- With respect to Section 7.B.(1) of Schedule D, an Adviser would need to indicate whether it considers ESG factors as part of one or more significant strategies in the advisory services it provides to each private fund it manages, and if so, report whether it employs in its management of that private fund an ESG-integration or ESG-focused approach, and if ESG-focused, whether it also employs an ESG-impact approach.

- With respect to the newly-added Item 5.M., Advisers would be required to report whether they follow any third-party ESG framework(s) in connection with their advisory services, and if so, the name and title of such framework(s).

These changes to Form ADV Part 1A would impact all Advisers filing on Form ADV, including SEC and state registered firms and exempt reporting advisers filing a truncated Form ADV Part 1 with state regulators and/or the SEC.

The Proposed Rules would further amend Form ADV Part 2A (Disclosure Brochure) and Form ADV Part 2A – Appendix (Wrap Brochure) to require Advisers to include ESG-related disclosures if such Advisers consider ESG factors as part of their investment strategies and analyses. The newly-required disclosures are as follows:

- Item 8 of the Disclosure Brochure: The Proposed Rules would require an Adviser to describe factors it considers for each significant ESG investment strategy or other analysis concerning ESG factors. In addition, the Adviser would be required to disclose how, and to what extent, ESG factors are integrated into its strategies. Further, if an Adviser uses, for any significant strategy, criteria or a particular methodology to exclude investments based on ESG factors, the Adviser must describe such criteria and methodology.

- Item 10 of the Disclosure Brochure: The Proposed Rules would require an Adviser to describe any relationships between the Adviser and any related person that is an ESG consultant or other ESG service provider, such as an ESG index provider or ESG scoring provider.

- Item 17 of the Disclosure Brochure: The Proposed Rules would require an Adviser to describe the ESG factors considered if the Adviser has specific proxy voting policies and procedures to include one or more ESG considerations when voting client securities.

- Item 4 of the Wrap Brochure: The Proposed Rules would require an Adviser to indicate any ESG factors considered and how such factors are analyzed when recommending portfolio managers.

These proposed changes to the Disclosure Brochure and Wrap Brochure in the Proposed Rules would impact all Advisers registered with the SEC, as well as those registered with state securities regulators.

Proposed ESG Disclosure Requirements for Registered Funds

Disclosures of ESG Strategy and GHG Emissions

The Proposed Rules would require a Registered Fund that implements ESG factors into its principal investment strategies to provide additional detail in prospectuses and annual shareholder reports regarding the its ESG strategy, consideration of GHG emissions and the use of proxy voting and engagement with issuers to achieve the Registered Fund’s ESG strategy. The amount and type of required disclosure is dependent on the extent to which ESG factors are considered by the Registered Fund in its investment strategy. The Proposed Rules identify the following types of ESG Registered Funds and the requisite disclosure requirements applicable to each such Registered Fund:

- Integration Funds5

- An Integration Fund is subject to limited ESG disclosure requirements. In its prospectus, an Integration Fund would be required to describe how it incorporates ESG factors into its investment selection process. Further, if the Integration Fund considers GHG emissions of portfolio holdings as an ESG factor, the Integration Fund must also specifically discuss how it considers such emissions and which data sources are used.

- An Integration Fund must ensure that its disclosures do not overemphasize or exaggerate the role of ESG factors in its investment strategy so as to risk misleading investors with respect to the significance of ESG factors associated with an investment in the Registered Fund.

- An Integration Fund is subject to limited ESG disclosure requirements. In its prospectus, an Integration Fund would be required to describe how it incorporates ESG factors into its investment selection process. Further, if the Integration Fund considers GHG emissions of portfolio holdings as an ESG factor, the Integration Fund must also specifically discuss how it considers such emissions and which data sources are used.

- ESG-Focused Funds6

- An ESG-Focused Fund would be required to provide detailed disclosure of the ESG factors implemented in its investment process.

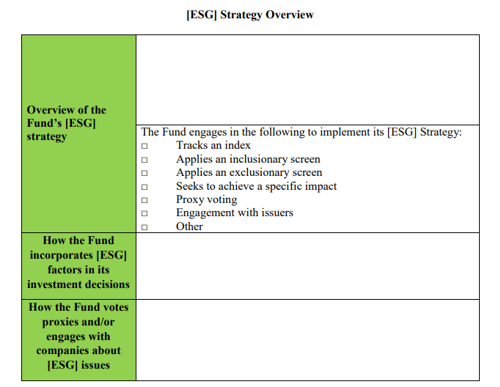

- An ESG-Focused Fund would be required to set forth its ESG strategy disclosures in an “ESG Strategy Overview” summary table in its prospectus, substantially in the following form as provided in the Proposed Rule, with a more detailed disclosure to be included later in the prospectus:

- An ESG-Focused Fund that considers environmental factors in its investment strategy would also be required to provide additional information regarding GHG emissions associated with its investments. Specifically, such an ESG-Focused Fund would be required to disclose in its annual shareholder report quantifiable GHG emissions metrics including, among other things, the carbon footprint and the weighted average carbon intensity of the investment portfolio in the aggregate.

- An ESG-Focused Fund would be required to provide detailed disclosure of the ESG factors implemented in its investment process.

- Impact Funds7

- As a subset of ESG-Focused Funds, the Proposed Rules would require an Impact Fund to provide the same disclosures as ESG-Focused Funds discussed above.

- In addition, an Impact Fund would be required to include disclosures regarding: (i) how it measures progress toward its specific ESG impact, including the key performance indicators it analyzes; (ii) the time horizon used to analyze progress; and (iii) the relationship between the ESG impact it is seeking to achieve and the financial return of the fund. The additional disclosures required for Impact Funds would be included in the “ESG Strategy Overview” table and would be accompanied by a more detailed description later in the prospectus. In addition, in its annual shareholder report, the Impact Fund would need to report its progress toward achieving the stated ESG impact in its annual shareholder report.

- As a subset of ESG-Focused Funds, the Proposed Rules would require an Impact Fund to provide the same disclosures as ESG-Focused Funds discussed above.

Disclosures Regarding Proxy Voting and Engagements with Issuers

Certain ESG-Focused Funds seek to (or purport to seek to) advance their ESG policies through proxy voting on ESG-related voting matters and through engaging with the management of issuers on ESG-related issues. According to the SEC, because such Registered Funds can bear significant influence regarding ESG matters, the Proposed Rules require that, if an ESG-Focused Fund used proxy voting or engagement with issuers as a

significant means of implementing its ESG Strategy, then such Registered Fund must disclose the arrangement in the “ESG Strategy Overview” table and include a detailed description later in the prospectus.

In addition, the Proposed Rules would require a Registered Fund that used proxy voting or engagement with issuers as a significant means of implementing its ESG strategy to disclose in its annual shareholder report information regarding how it voted proxies on ESG-related voting matters and provide additional information regarding its ESG engagement meetings with issuers.

Presentation of ESG Disclosures

The Proposed Rule would require all ESG-related disclosure information in registration statements and annual shareholder reports of Registered Funds to be tagged using Inline eXtensible Business Reporting Language (Inline XBRL).

Proposed Names Rule for Funds

The Proposed Rules would amend the current Names Rule applicable to Registered Funds by, among other things:

- Expanding the rule to require any Registered Fund with a name that suggests a focus in certain investments or issuers with particular characteristics to invest at least 80 percent of its assets in accordance with such focus.

- Establishing time frames for a Registered Fund to re-establish its 80 percent investment policy following temporary deviations caused by events such as market fluctuations, large cash inflows and large redemptions.

- Enhancing prospectus disclosures and reporting with respect to how a Registered Fund’s name correlates with its investments.

The Proposed Rule specifically states that the name of an Integration Fund would be materially misleading if the name indicates that its investment strategy incorporates ESG factors.

Time Frame for Implementation

If the Proposed Rules are adopted, Registered Funds and Advisers must comply with the new disclosure and Name Rule requirements within one year of the publication of the final rules, as applicable. During such time, Registered Funds and Advisers will need to establish a framework to identify mandated ESG disclosures. Further, Registered Funds will need to assess their compliance with the Names Rule and establish systems for tracking such compliance. The comment period associated with the Proposed Rules ends 60 days after their publication in the Federal Register.

The final form of the rules may materially differ from the Proposed Rules. Lowenstein Sandler will monitor the status of the Proposed Rules and provide additional updates and analysis in future Client Alerts. Please contact one of the listed authors of this Client Alert or your regular Lowenstein Sandler contact if you have any questions regarding the Proposed Rules.

1 Throughout this article, we refer to registered investment advisers, including certain advisers that are exempt from registration, as “Advisers” and registered investment companies and business development companies as “Registered Funds.”

2 As described in further detail below, the Proposed Rules propose expansion of the “Names Rule” which applies to Registered Funds with names that suggest a focus in investments or issuers with particular characteristics.

3 The Proposed Rules can be found here:(https://www.sec.gov/rules/proposed/2022/ia-6034.pdf).

4 Such disclosures are required under various rules promulgated under the Investment Company Act and Investment Advisers Act of 1940, as amended.

5 Proposed Rules define an Integration Fund as a “fund that considers one or more ESG factors along with other, non-ESG factors in its investment decisions, but those ESG factors are generally no more significant than other factors in the investment selection process.”

6 The Proposed Rules define an ESG-Focused Fund as a “fund that focuses on one or more ESG factors by using them as a significant or main consideration (1) in selecting investments or (2) in its engagement strategy with the companies in which it invests.”

7 The Proposed Rules define an Impact Fund as an ESG-Focused Fund that “that selects investments to seek to achieve a specific ESG impact or impacts.”