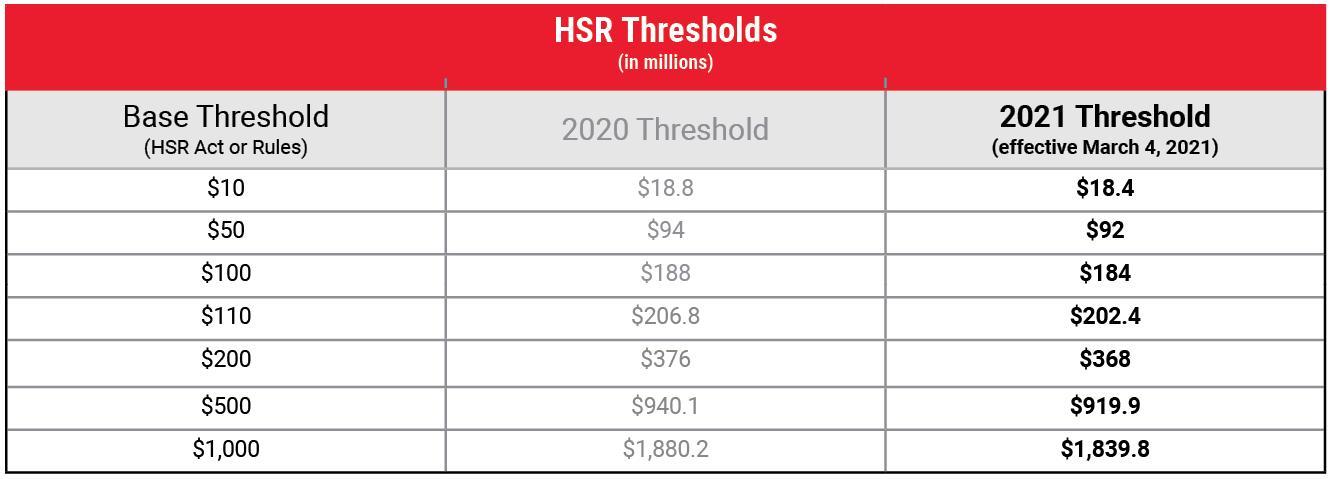

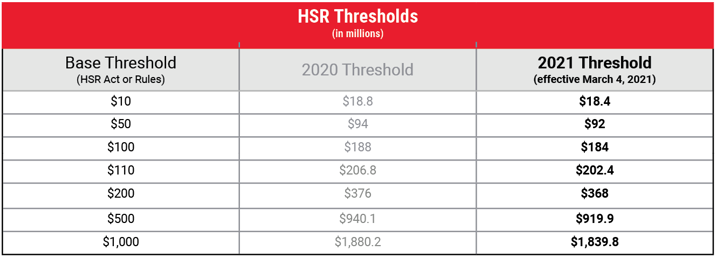

The Federal Trade Commission has announced new, slightly lower premerger notification thresholds that will take effect March 4, 2021, and thus apply to transactions closing on or after that date. The new minimum size-of-transaction threshold will be $92 million.

Under the 2001 amendments to the Hart-Scott-Rodino (HSR) Act, 15 U.S.C. 18a, the act’s jurisdictional thresholds are adjusted annually to reflect changes in nominal (non-inflation-adjusted) gross national product. The newly announced adjustments will reduce the HSR Act thresholds by approximately 2.1 percent. These downward adjustments for 2021 mark only the second year (the other being 2010) in which HSR thresholds were adjusted downward.

Adjustments to size-of-transaction thresholds

Transactions that are never reportable: The new minimum size-of-transaction threshold of $92 million represents a decrease of $2 million from the current $94 million threshold. Thus, a transaction that results in holdings of $92 million or less will not require HSR notification. (Note, though, that a $93 million transaction, which would not have required HSR notification before March 4, 2021, could trigger HSR thereafter.)

Transactions that are always reportable: At the other end of the size spectrum, a transaction that results in holdings of more than $368 million will trigger HSR notification and waiting requirements unless an exemption from filing applies.

Transactions that may be reportable: For transactions resulting in holdings falling between these two size-of-transaction thresholds (that is, greater than $92 million but no greater than $368 million), whether HSR applies depends on whether both parties meet the size-of-person thresholds. (Note that these thresholds apply to the size of the parties and not merely to the size of the acquiring entity and the acquired entity, so it is necessary to look to the ultimate parent entity of each and include all entities controlled by it.)

Adjustments to size-of-person thresholds

The adjusted size-of-person thresholds are $18.4 million and $184 million, meaning that acquisitions resulting in holdings greater than $92 million but no greater than $368 million will not require HSR notification unless one person has total assets or annual net sales of $18.4 million or more and the other person $184 million or more. (Note that, additionally, if the acquired person is not engaged in manufacturing, it must have annual net sales of $184 million or total assets of $18.4 million.)

What else changes?

The HSR Rules (16 CFR parts 801-803) provide several exemptions that contain dollar value limitations described by the parenthetical “(as adjusted).” Those limitations (for example, the nexus with commerce limitations for the exemptions for acquisitions of foreign assets (16 CFR 802.50) and acquisitions of voting securities of a foreign issuer (16 CFR 802.51)) will also be adjusted downward.

The HSR Rules also provide, for voting securities acquisitions, “notification thresholds” (see 16 CFR 801.1(h)) setting forth levels of holdings that would require another HSR notification. (Note, however, that once the 50 percent level is reached, no additional notification is required.) As the dollar values for these notification thresholds are set forth with the parenthetical “(as adjusted),” they will similarly be adjusted downward.

The 2001 amendments established a sliding scale for HSR filing fees, with fees of $45,000, $125,000, or $280,000 based on the transaction value. While the filing fees themselves are not adjusted annually, the points at which the different fees apply are adjusted, so that the $45,000 fee will apply to transactions valued in excess of $92 million but less than $184 million, the $125,000 fee to transactions valued at $184 million or greater but less than $919.9 million, and the $280,000 fee to transactions valued at $919.9 million or greater.