On March 21, 2022, the Securities and Exchange Commission (SEC) issued proposed rules to enhance and standardize a registrant’s climate-related disclosures in registration statements and annual reports (Proposed Rules).1 Readers are reminded that the Proposed Rules remain subject to public comment, which is anticipated to occur at historic levels, and thus any adopted final rules may be different from what is included in the Proposed Rules.

Background and Context

Prior to the Proposed Rules, the SEC had most recently published guidance regarding climate change disclosure matters in 2010.2 Notwithstanding that prior guidance, given the intensive public discourse surrounding climate change and the increased demand from certain investors for more consistent, comparable, and reliable information about climate-related risks, the SEC believes improved disclosures by registrants regarding climate-related impacts are warranted. Accordingly, the Proposed Rules aim to enhance and standardize disclosures so that a registrant may more effectively and efficiently disclose climate-related risks that may have material impacts on the registrant’s business or financial results. The Proposed Rules borrow certain terms and concepts from generally accepted disclosure frameworks already existing in the marketplace, such as the “Task Force on Climate-Related Financial Disclosures” and the “Greenhouse Gas Protocol.”

Citing registrants that have made commitments with respect to climate change (e.g., “net zero”), the Proposed Rules seek more detailed disclosures about these commitments, including specific targets and the registrant’s related plans to satisfy those targets, in part to allow investors to assess the credibility of such commitments but also to provide information that can be compared across the market.

Proposed Disclosure Requirements

The Proposed Rules would require a registrant to include disclosures concerning the below items (among others):

- The oversight and governance functions of the registrant’s board and management with respect to climate-related risks, including the processes established for identifying, assessing, and managing such risks

- How climate-related risks have had or are likely to have a material impact on the registrant’s business and financial statements over the short-, medium-, or long-term, and whether such risks have affected or are likely to affect the registrant’s strategy, business model, and outlook

- The impact of climate-related events (e.g., severe weather events) and transition activities (e.g., transition to carbonless operations) on the line items of a registrant’s financial statements, including the financial estimates and assumptions used in the financial statements

- Separate disclosure of a registrant’s direct GHG emissions (referred to as “Scope 1 emissions”3) and indirect GHG emissions (referred to as “Scope 2 emissions”4) in “absolute and intensity terms”

- A registrant’s indirect GHG emissions in its value chain (referred to as “Scope 3 emissions”5) in “absolute and intensity terms”

- The registrant’s publicly disclosed climate-related targets and goals, if any, and how the registrant intends to meet such targets and goals and any progress made toward achieving them

Presentation

The Proposed Rules would require a registrant to include climate-related disclosures in its registration statements and Exchange Act annual reports, and provide the Regulation S-X mandated climate-related financial statement metrics and related disclosures in a note to the registrant’s audited financial statements. Also, similar to the treatment of other important business and financial information, the Proposed Rules would require a registrant to disclose any material change to the climate-related disclosures provided in a registration statement or annual report in its Form 10-Q (or, in certain circumstances, Form 6-K for a registrant that is a foreign private issuer that does not report on domestic forms).

The Proposed Rules would also require that the climate-related disclosures be “filed” and therefore subject to potential liability under Exchange Act Section 18 (other than disclosures included on Form 6-K).

Attestation Requirements

If the registrant is an accelerated or large filer, the Proposed Rules would require the registrant to include an attestation report from an independent attestation service provider covering disclosures relating to Scope 1 emissions and Scope 2 emissions. The Proposed Rules require an attestation service provider to meet certain minimum qualifications, such as independence from the registrant, and the use of standards that are public and subject to due diligence. The attestation service provider would be subject to liability under the federal securities laws for the attestation conclusion or, when applicable, the opinion provided. The SEC believes such liability will encourage the attestation service provider to exercise due diligence with respect to its obligations under a limited or reasonable assurance engagement.

The attestation service provider is not required to be a registered public accounting firm.

Accommodations and Phase-In Periods

The Proposed Rules include safe harbors for liability with respect to Scope 3 emissions disclosures and forward-looking statements pursuant to the Private Securities Litigation Reform Act. Further, the Proposed Rules include an exemption from the Scope 3 emissions disclosure requirement for smaller reporting companies.

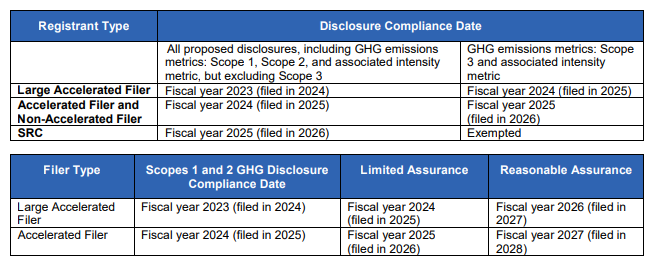

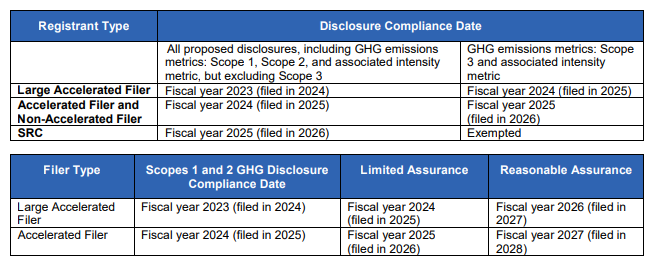

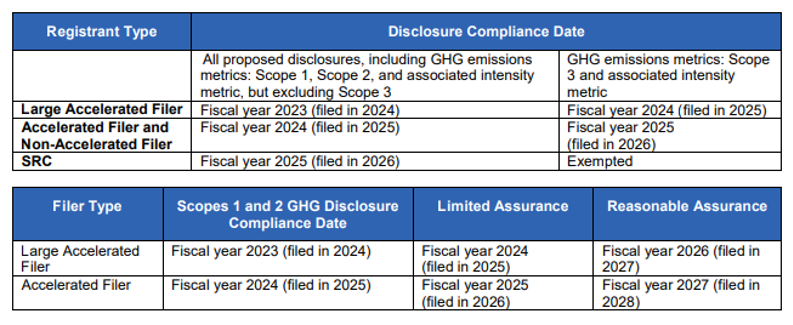

The Proposed Rules also include phase-in periods for a registrant with respect to compliance dates and Scope 3 emissions disclosures and assurance requirements. An illustrative summary of the phase-in periods is set forth in the Proposed Rules, which is reproduced below. The following tables assume the Proposed Rules will be adopted with an effective date in December 2022 and that the registrant has a December 31 fiscal year-end.

Key Takeaways for Public Companies and Their Board of Directors and Management

If the Proposed Rules are adopted, registrants must establish or otherwise bolster board and management governance functions with respect to climate-related risks in order to identify, assess, and determine mandated disclosures. The assessment of which climate-related risks are material to the registrant’s business and financial statements will involve collaboration among the board, management, and outside advisors, such as accounting firms and environmental consultants. In addition, registrants should consider whether they will create climate-related targets and goals, and if so, how they will measure their progress toward such targets and goals.

1 The Proposed Rules can be found here (https://www.sec.gov/rules/proposed/2022/33-11042.pdf)

2 SEC Release Nos. Nos. 33-9106; 34-61469; FR-82 “Commission Guidance Regarding Disclosure Related to Climate Change” (https://www.sec.gov/rules/interp/2010/33-9106.pdf)

3 Scope 1 emissions are direct GHG emissions that occur from sources owned or controlled by the company. These might include emissions from company-owned or controlled machinery or vehicles, or methane emissions from petroleum operations

4 Scope 2 emissions are those emissions primarily resulting from the generation of electricity purchased and consumed by the company

5 Scope 3 emissions are all other indirect emissions not accounted for in Scope 2 emissions; These emissions are a consequence of the company’s activities but are generated from sources that are neither owned nor controlled by the company; for example, these might include emissions associated with the production and transportation of goods a registrant purchases from third parties, employee commuting or business travel, and the processing or use of the registrant’s products by third parties.