The proposed rules would:

- Accelerate certain filing deadlines for Schedules 13D and 13G

- Expand the definition of “beneficial ownership” to capture cash-settled derivatives

- Alter the circumstances under which two or more persons have formed a “group” for beneficial ownership reporting purposes

Background

On February 10, 2022, the Securities and Exchange Commission (the SEC) released its long-awaited set of proposed rules (the Proposal)1 which, if adopted, would alter certain aspects of beneficial ownership reporting under Sections 13(d) and 13(g) of the Exchange Act of 1934, and Regulation 13D-G thereunder.

Proposed Changes

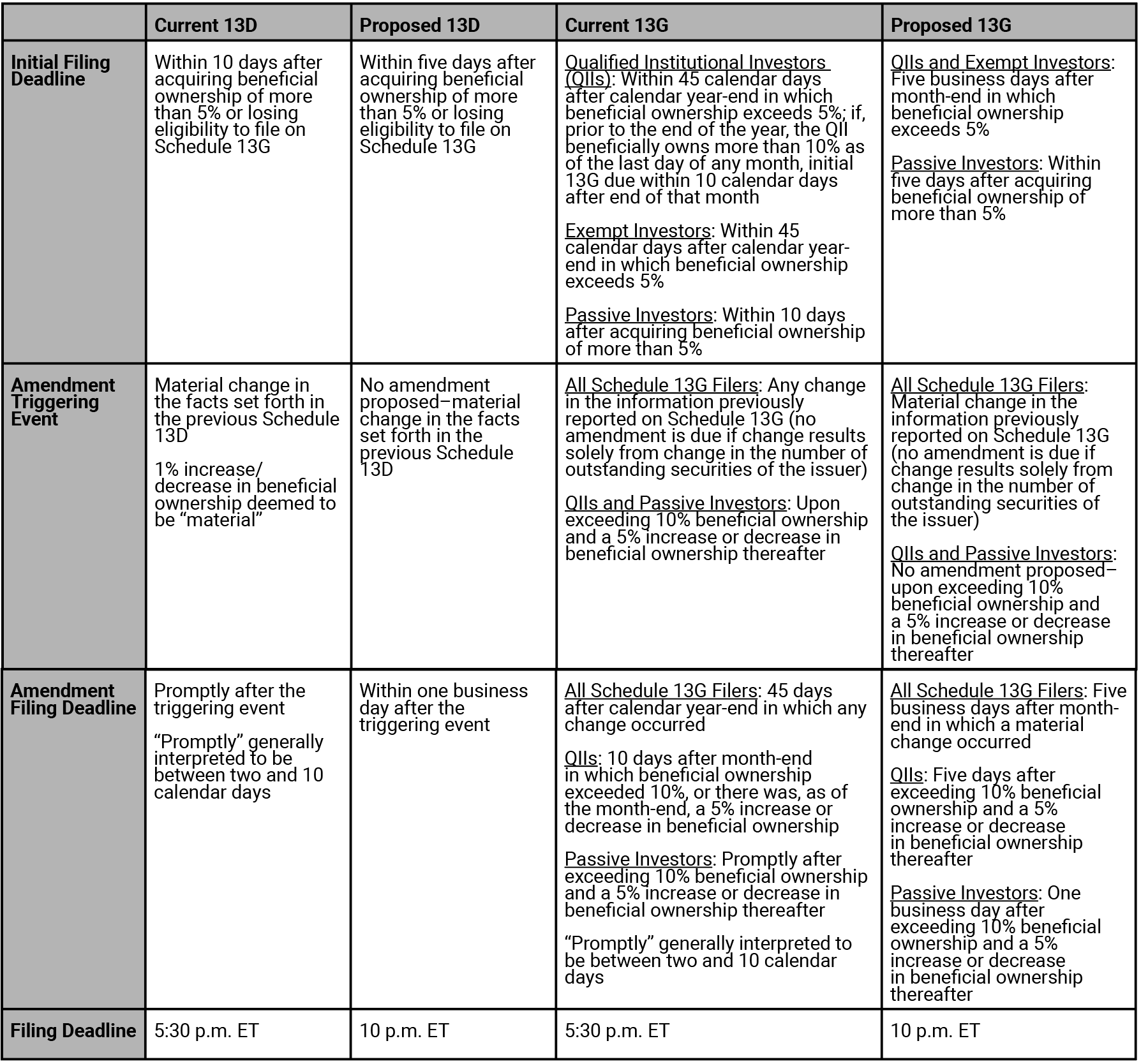

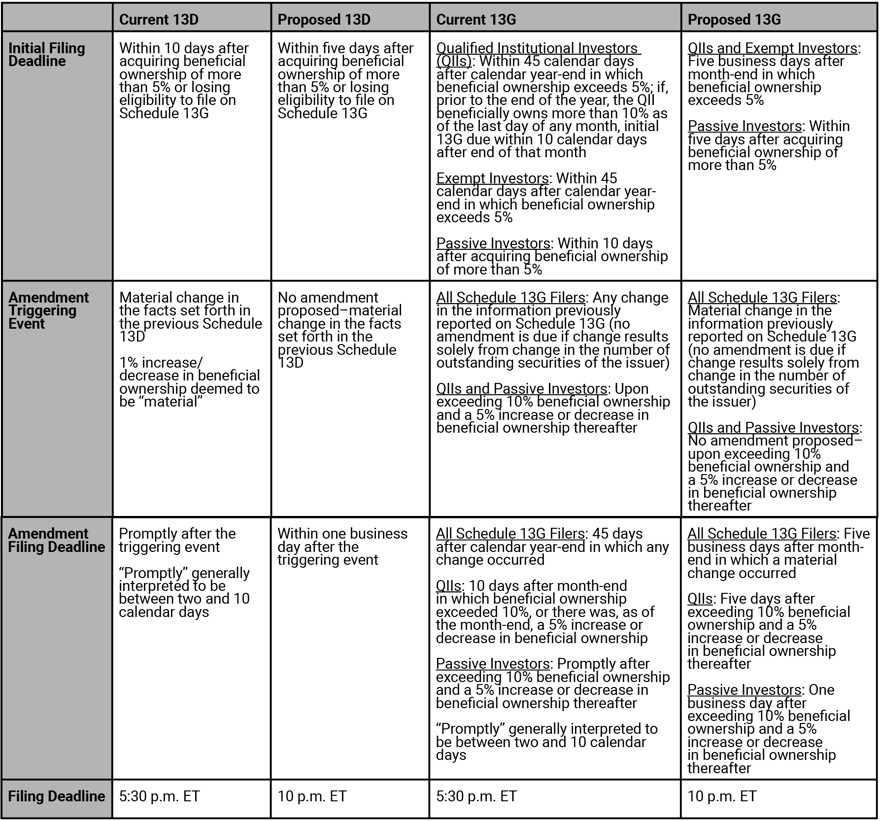

Below is a table that is included in the Proposal, supplemented with information from the authors of this Client Alert, which compares the general beneficial ownership reporting timelines as they currently exist to the proposed standards as set forth in the Proposal.

Cash-Settled Derivative Securities

In addition to the above changes to filing deadlines, the Proposal would deem holders of certain cash-settled derivative securities to be beneficial owners of the reference equity securities if the derivative is held with the purpose or effect of changing or influencing the control of the issuer. For example, a holder of a cash-settled derivative security, other than a security-based swap, could be deemed the beneficial owner of the reference equity securities in the presence of influence/control intent.

In addition, the Proposal looks to amend Item 6 to Schedule 13D to require disclosure of all interests in derivative securities (including cash-settled derivative securities) that use the issuer’s equity security as a reference security.

Formation of ‘Group’

Finally, pursuant to the Proposal, a person who shares information about an upcoming Schedule 13D filing that such person will be required to make, to the extent this information is not yet public and communicated with the purpose of causing others to make purchases, and a person who subsequently purchases the issuer’s securities based on this information will be deemed to have formed a “group” within the meaning of Section 13.

Next Steps

The authors of this Client Alert will continue to monitor the Proposal and any new developments related thereto. Please contact one of the listed authors of this Client Alert or your usual Lowenstein Sandler contact if you have any questions with respect to proposed rule changes or any other matters.

1 SEC Release Nos. 33-11030; 34-94211 “Modernization of Beneficial Ownership Reporting” (https://www.sec.gov/rules/proposed/2022/33-11030.pdf)