On January 10, 2023, Gov. Phil Murphy signed a substantial new version of New Jersey’s Worker Adjustment and Retraining Notification Act (WARN Act), which will take effect in 90 days. The amended New Jersey WARN Act imposes requirements in addition to those under the federal WARN Act for employers with 100 or more employees.

As we discussed in a prior client alert, on January 21, 2020, Murphy previously signed the amended New Jersey WARN Act, which was supposed to take effect on July 20, 2020. In response to the COVID-19 pandemic, Murphy signed Executive Order 103 on April 14, 2020, declaring a public health emergency and state of emergency. As a result, the effective date of the amended New Jersey WARN Act was intended to be postponed to 90 days following the termination of the state of emergency. Throughout the pandemic, Murphy continued to renew Executive Order 103, which continued to delay the amended New Jersey WARN Act’s implementation.

Yesterday, Murphy signed a bill that will implement the new version of the New Jersey WARN Act in 90 days, even though Executive Order 103 and the State of Emergency remain in effect.

Changes in the WARN Act

As employers may be aware, any time they conduct a layoff, they need to be mindful of considerations under both the federal WARN Act and any applicable state WARN Acts. There are situations in many states where even if a layoff does not meet the federal WARN Act threshold, a state law’s WARN Act could apply.

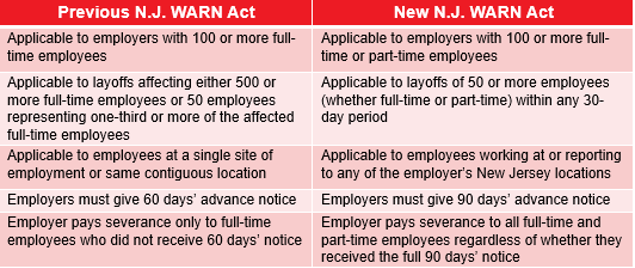

Previously, the New Jersey WARN Act applied to employers with 100 or more full-time employees. Now, the amended New Jersey WARN Act will apply to employers with 100 or more full-time or part-time employees.

In addition, while New Jersey’s prior law, like the federal law, focused on whether the impacted employees worked at a “single site of employment,” the new law in New Jersey expands the application of the WARN Act to employers laying off 50 or more full-time or part-time employees at or reporting to all of the employer’s New Jersey locations, effectively eliminating a site-by-site analysis to determine if the WARN Act is triggered.

The earlier New Jersey WARN Act required employers to give 60 days’ advance notice of a qualifying shutdown, transfer, or mass layoff. The employer was required to pay severance only if the employer did not give the full 60 days’ notice. By contrast, and in a much more expansive role than either the federal WARN Act or the WARN Act in any other state, the amended New Jersey WARN Act requires employers to give 90 days’ advance notice of termination AND to pay severance equal to one week’s salary for every full year of employment even if the employer complied with the notice requirements. In making severance mandatory and automatic, New Jersey becomes the only state in the country to require severance pay for all employees who lose their jobs in a WARN Act event. If an employer does not comply with the full 90-day notice requirement, the employer will be required to pay an additional four weeks of severance.

The federal WARN Act recognizes that some employers are unable to provide advance notice of termination to their employees when there are unforeseeable business circumstances, when the company meets the faltering business exception, or if there is a natural disaster. Unlike in the federal WARN Act, the only exception recognized under the New Jersey WARN Act is the natural disaster exception, such as when there is a flood, fire, or other emergency.

New Jersey enacted the previous WARN Act in 2007, which at the time largely mirrored the federal WARN Act. However, the expansive definition of what constitutes an “establishment,” the lengthy notice period, and the requirement to pay mandatory severance on top of notice in New Jersey’s new WARN Act make it among the most draconian state WARN Acts in the country. In the event of a layoff, employers must ensure they comply with both the state and federal WARN Acts, and there are now substantially different requirements.

Caution for Employers

- Plan mass layoffs in advance to comply with the new 90-day notice requirement and to avoid paying an additional four weeks of severance pay.

- Consider the mandatory severance payments in budgeting.

- Evaluate whether the WARN Act is newly applicable to the company because both full-time and part-time employees are now considered in the 100-employee threshold.

- Comply with both the New Jersey WARN Act and the Federal WARN Act.

If you need assistance navigating the amended New Jersey WARN Act, please contact Lowenstein Sandler’s Employment Counseling and Litigation practice group.