Last week, the U.S. Supreme Court officially overturned Roe v. Wade in its consequential decision, Dobbs v. Jackson Women’s Health Organization. With federal protection for abortion now dissolved, many employers are considering how they can assist their employees who live in states where access to abortion is not available. Thoughts have quickly turned to providing assistance to enable those employees to travel to a state where abortion is legal. Questions that arise include whether providing travel assistance for such purpose is permissible, how travel assistance may be provided, whether and to what extent travel reimbursements are taxable, and how such a benefit can be provided while addressing an employee’s concerns about privacy.

While the legal question of whether states will be permitted to impose “travel bans” as a restriction remains unanswered, in the meantime a number of states have seen an increase in nonresidents crossing state lines to access the procedure. For example, after Texas banned almost all abortions six weeks after conception, Planned Parenthood reported that its clinics in neighboring states saw an almost 800 percent increase in abortion patients.

Recognizing that traveling for an abortion is not financially or logistically possible for everyone, several large employers, including Starbucks, Tesla, JPMorgan Chase, Meta, Dick’s Sporting Goods, Condé Nast, and others, have announced plans to implement policies to cover travel expenses for employees who must travel out of state to access these health services. Lyft and Uber, in addition to expanding the company’s insurance coverage to include “a range of reproductive health benefits, including pregnancy termination,” also pledged to reimburse their drivers’ legal expenses if a driver is sued under state law for providing transportation to a clinic. The list of employers announcing plans to provide travel assistance and other benefits to help employees in restrictive states grows daily.

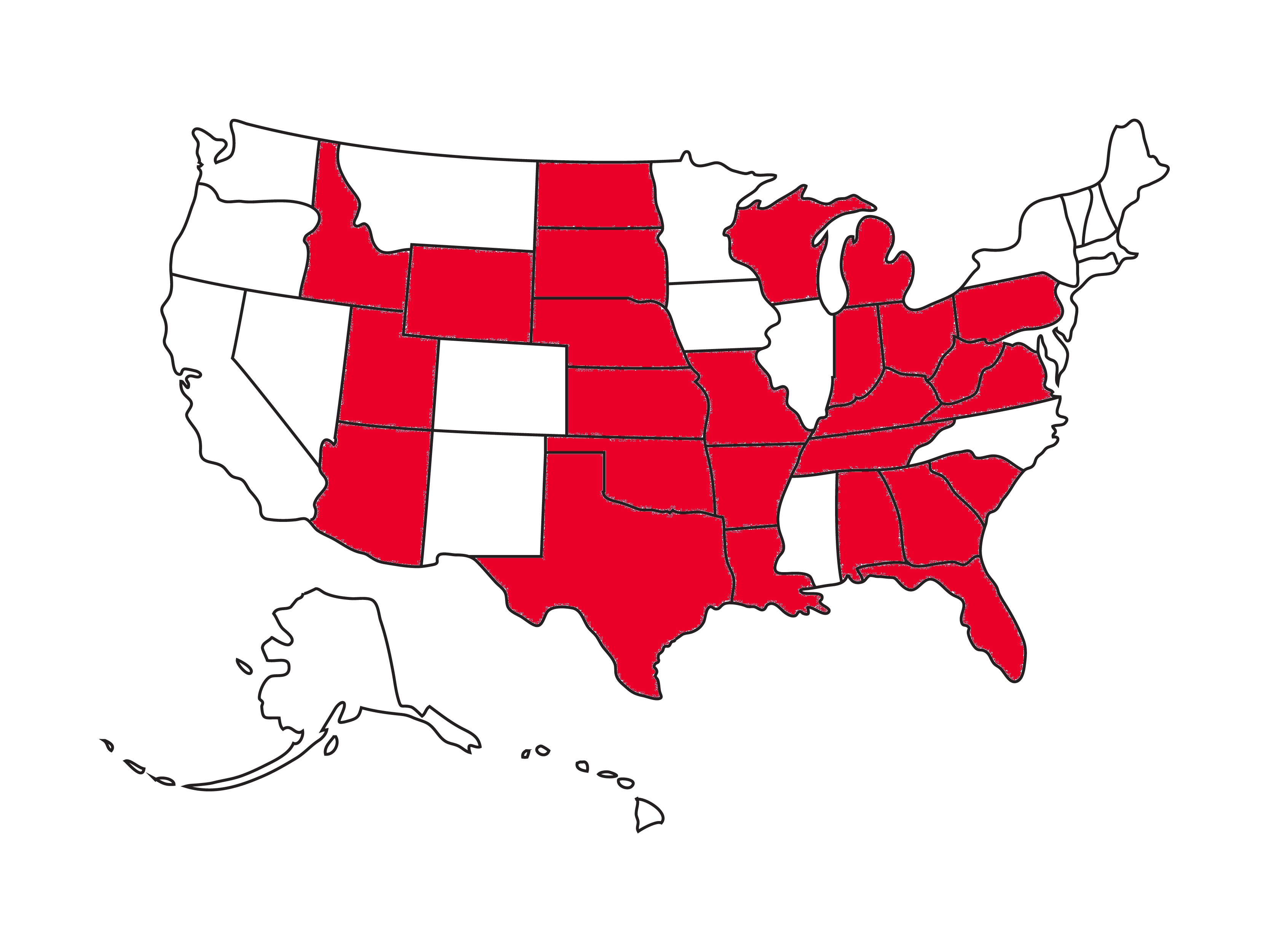

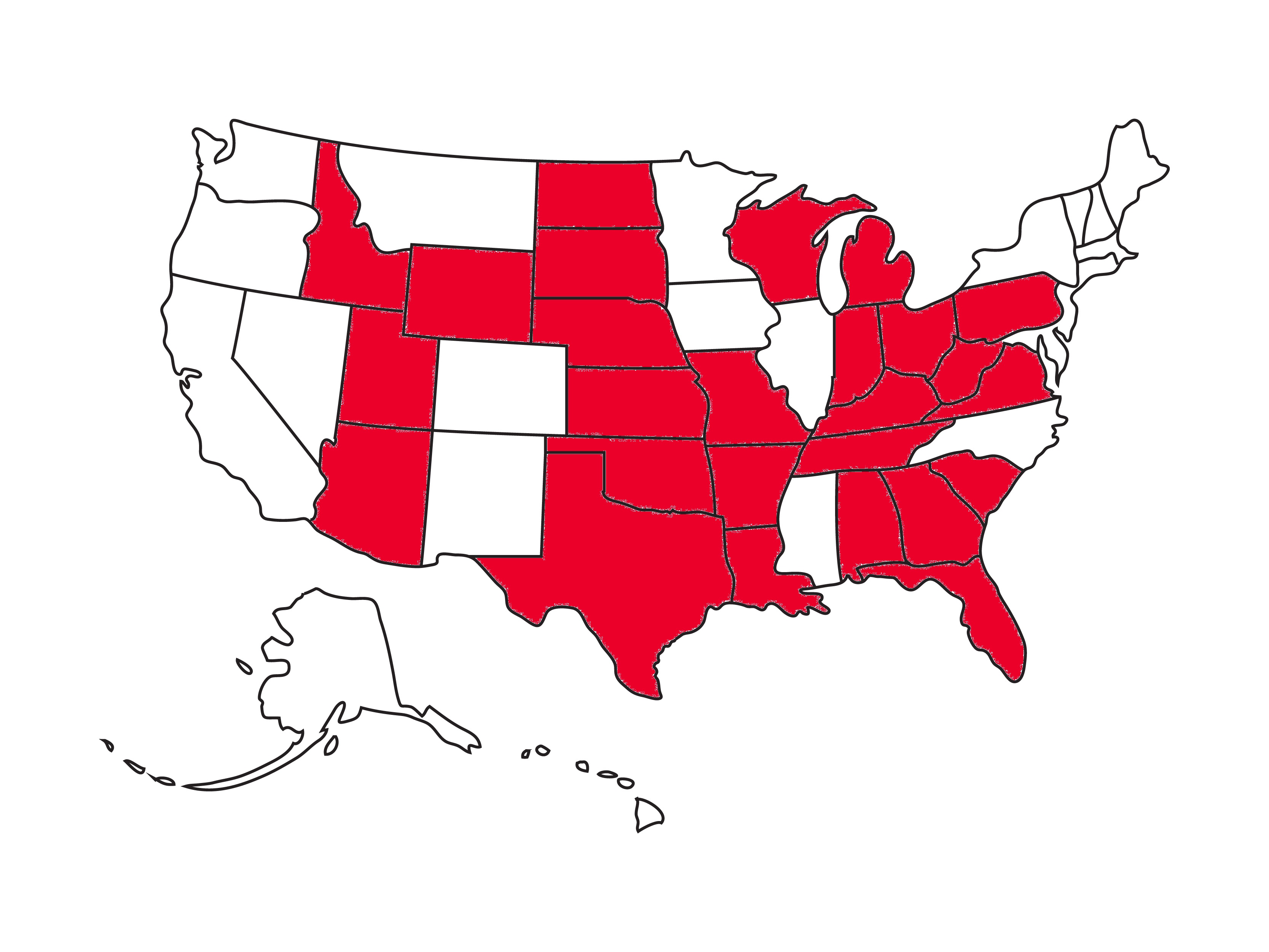

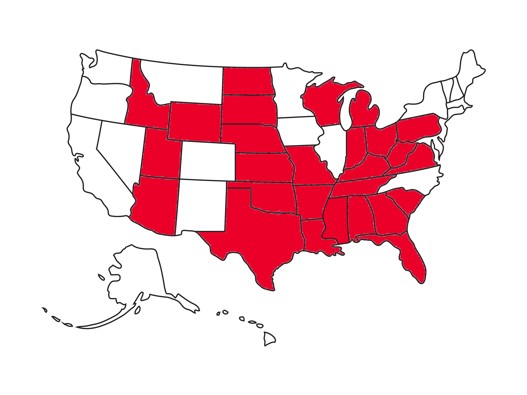

The map below shows in red the states that currently have full or partial bans on abortion.

An employer interested in providing abortion-related travel assistance to employees should consider the following issues.

Is it permissible to provide abortion-related travel assistance?

There are reports of some states considering bans on interstate travel for an abortion, but as of this writing, there do not appear to be any state laws that do so. Some reports have raised the prospect of a state asserting “aiding and abetting” criminal laws to punish employers that pay the travel costs of workers crossing state lines to access an abortion procedure. For a variety of reasons, that possibility seems remote, but this is a developing legal environment that will require monitoring.

Reports also suggest that some states are considering prohibiting health plans from covering abortion-related services. The Employee Retirement Income Security Act of 1974 (ERISA), the federal law that governs employee benefit plans, generally preempts state laws to the extent the state law “relates to” an employee benefit plan. A majority of large employers have self-insured health plans, which (unlike insured health plans) enjoy the benefits of ERISA preemption. Thus, to the extent that a state law purports to restrict a self-insured health plan from covering abortion-related services, such law may be preempted by ERISA. Legal challenges to state laws prohibiting travel to obtain an abortion are all but certain.

How may an employer provide abortion-related travel assistance?

An employer’s group health plan is likely to cover certain transportation-related expenses for medical care (including an abortion) regardless of whether the coverage is provided under a fully insured plan or a self-insured plan. However, plans would be expected to have limitations on such coverage. While amounts paid under a group health plan for a “legal abortion” are excludible from income under the Internal Revenue Code (IRC) as medical care expenses, such amounts are subject to limits that likely will not cover the full cost of interstate travel and lodging. For example, the exclusion for lodging away from home for the treatment of medical care is capped at $50 per night per individual.

Given these limits, employers that maintain self-insured health plans could consider increasing the reimbursement for abortion-related transportation under the plan. Employers that have fully insured health plans may consider establishing a supplemental reimbursement policy. However, benefits paid under a self-insured plan or a supplemental reimbursement policy in excess of IRC limits will be treated as taxable income to the employee. An employer may consider grossing up the reimbursement to cover the employee’s taxes as well.

Care should be taken in establishing a supplemental reimbursement policy, however, because the supplement might be considered a separate group health plan that is subject to the requirements of ERISA, the Affordable Care Act (ACA), and other laws to which group health plans are subject. Among other things, the ACA generally precludes a group health plan from imposing annual and lifetime limits on benefit coverages. Employers establishing supplemental travel-assistance arrangements should consider avoiding such limits in the event the arrangement is considered a separate group health plan. As a result, employers should seek the advice of counsel in drafting and implementing a supplemental travel assistance plan or policy.

Employers that provide health coverage through a professional employer organization (PEO) should coordinate any supplemental travel reimbursement with the coverage provided by the PEO.

How can an employer protect its employees’ privacy when providing abortion benefits?

Well-meaning employers need to consider that employees may be hesitant to inform their employer that they need an abortion because of privacy concerns. Employees’ privacy could be jeopardized, depending on how these travel reimbursements are incorporated into existing health plans. While companies may try to set a predetermined stipend for abortion travel, there is no guarantee that this benefit would be viewed separately from a health plan, since abortion is considered medical care.

Additionally, privacy protections provided by the Health Insurance Portability and Accountability Act would not apply to data collected outside a group health plan for abortion travel. For example, abortion providers may disclose health information about the procedure(s) provided to an employee in order to bill and collect payment from the employer’s health plan. This may deter many employees from electing to use these benefits out of fear that their employer or others at the company will find out about their need for an abortion. The federal Pregnancy Discrimination Act, Americans with Disabilities Act, and Family and Medical Leave Act of 1993, as well as some state laws, may protect workers more broadly from discrimination or retaliation by their employer with regard to accessing an abortion. As of 2019, New York state law expressly prohibits employers from discriminating against their employees based upon their sexual and reproductive health decisions.

The best way an employer can protect an employee’s privacy is to use a third-party service to arrange for abortion procedures. For example, it is reported that the company Match has established a fund that directly pays into Planned Parenthood for all travel and lodging related to an abortion procedure. Handling this benefit through a third party or a third-party administrator helps ensure the employee’s privacy.

Must an employer that supplements abortion-related transportation costs also reimburse similar costs for other medical procedures?

Employers that reimburse employees for interstate travel for abortion-related services should consider whether to also cover interstate travel costs for other medical treatments. Of course, the difference between most other health services and abortion services is that the former likely are available in the state where the employee resides. However, there may be procedures (such as gender transitioning services) that are not available in a state or that become unavailable in the future.

The law in this area continues to evolve. If you are an employer considering how to provide abortion-related benefits to employees, please contact a member of Lowenstein Sandler’s Executive Compensation and Benefits Group or Employment Practice Group.