On December 20, 2019, President Trump signed new tax legislation called the Setting Every Community Up for Retirement Enhancement Act of 2019 (the SECURE Act). The SECURE Act is expected to impact individuals’ retirement planning and broaden retirement plan access for small employers. Sponsors of tax-qualified plans will also need to amend their plans (though not immediately).

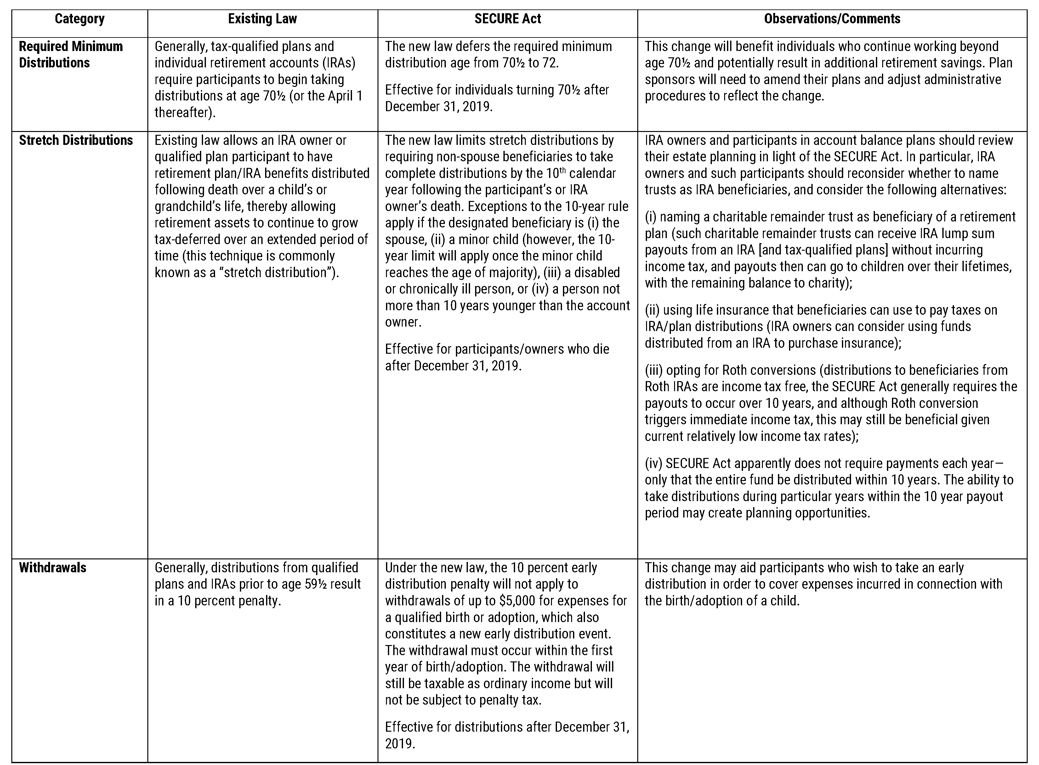

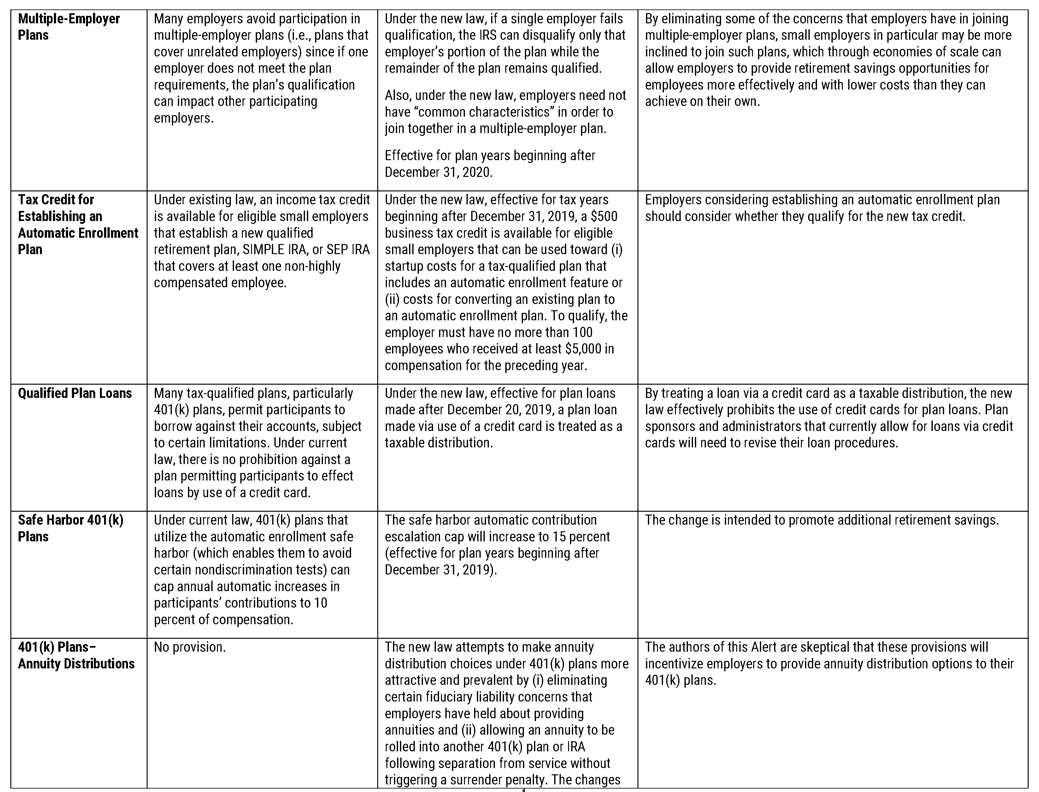

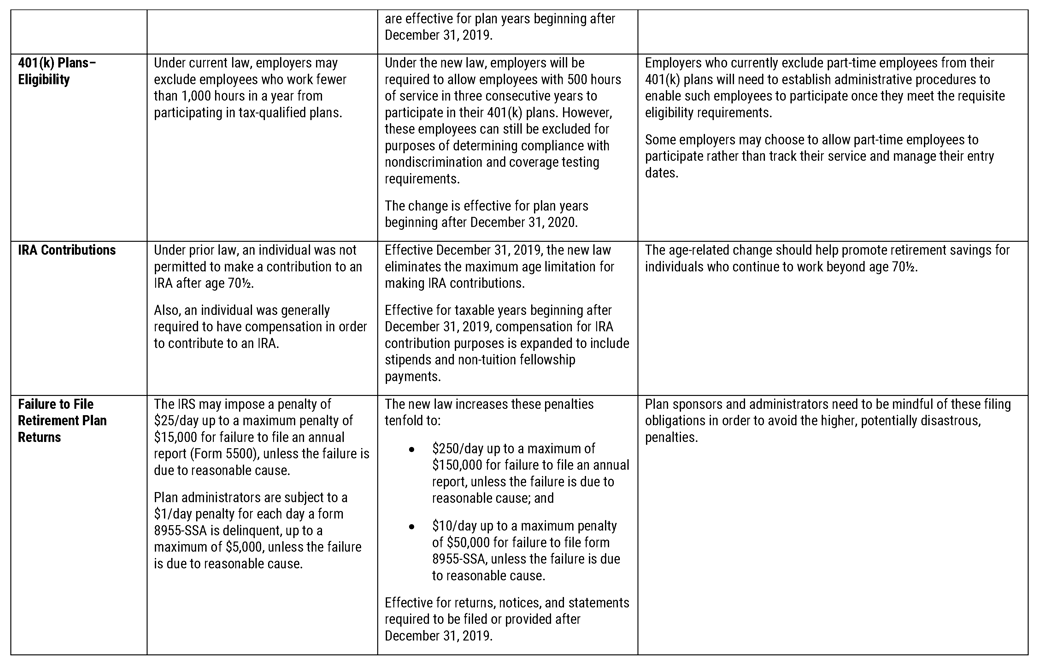

The chart below briefly summarizes many elements of the SECURE Act and provides some observations about the changes for those affected by the new law to consider:

As indicated above, the SECURE Act made a number of changes that will influence retirement planning and plan design. The lawyers in our Employee Benefits and Executive Compensation Practice Group and Trusts and Estates Practice Group are ready to assist with any questions you may have and to advise on how best to address the effects of the SECURE Act on your plans and retirement/estate planning.

Some of the changes summarized above that affect tax-qualified plans will require that employers amend their plans. Under the SECURE Act, amendments are generally not required until the last day of the first plan year beginning on or after January 1, 2022, but employers who wish to implement changes permitted by the SECURE Act will likely need to amend their plans at the time those changes are implemented. Employers and plan administrators should watch for additional Client Alerts from us regarding the content and timing of appropriate amendments as anticipated guidance from the IRS is issued.