On December 20, 2017, Congress passed a statute originally named the Tax Cuts and Jobs Act (the “Act”), which enacts a broad range of tax changes. The Act was signed by the President on December 22. This alert briefly summarizes some of the key federal income tax provisions of the Act relating to individuals.

The Act has numerous provisions affecting individual taxpayers. In this alert, we focus on the provisions most likely to impact our clients. Most of the Act’s provisions take effect beginning on January 1, 2018. Many of the provisions are scheduled to “sunset” after 2025, at which point pre-Act law will apply unless Congress acts again.

New Individual Income Tax Rates and Brackets

Ordinary Income Tax Rates

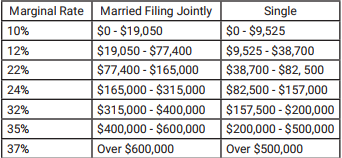

The Act modifies the existing tax rate structure, reducing the top marginal ordinary income tax rate from 39.6% to 37%. The new rate structure for 2018 (to be indexed for inflation thereafter) is as follows:

Capital Gain Tax Rates: Status Quo

The Act preserves the 0%, 15%, and 20% tax brackets for longterm capital gains and qualified dividend income based on the same breakpoints as under pre-Act law. For joint filers in 2018, the 15% bracket begins at $77,200 and the 20% bracket at $479,000 ($38,600 and $425,800 for single taxpayers, respectively). The breakpoints will be indexed for inflation for tax years after 2018.

The Act does not eliminate or modify the 3.8% net investment income tax. Note that the Act did not adopt the Senate bill’s requirement that taxpayers use the “first-in, first-out” rule in determining which securities have been sold. Thus, taxpayers will be able to continue to identify which specific block of securities is being sold (and may, e.g., elect to sell high-basis securities or contribute low-basis securities to charity).

Increased Standard Deduction/Elimination of Personal Exemptions

The Act increases the standard deduction to $24,000 for married individuals filing jointly, $18,000 for head-of-household filers, and $12,000 for all other individuals, adjusted for inflation in tax years after 2018. The increased standard deduction, coupled with the loss of many itemized deductions (discussed below), will reduce the number of taxpayers who itemize deductions.

In addition, the Act eliminates the deduction for personal exemptions. Note that this may cause withholding rules on wages to change, although for 2018 the IRS has been given discretion to maintain current wage withholding rules.

The child tax credit is increased to $2,000 (with a maximum refundable amount of $1,400) per qualifying child. A nonrefundable credit of $500 for each qualifying dependent other than a qualifying child may be available to certain taxpayers. The credits begin to phase out for taxpayers with adjusted gross income (“AGI”) over $400,000 for joint filers and $200,000 for all other taxpayers.

Alternative Minimum Tax (the “AMT”) Retained with Increased Exemption Amounts

The Act retains the individual AMT but increases the exemption amount (to $109,400 for joint filers, $54,700 for married taxpayers filing separate returns, and $70,300 for single filers). The phase-out thresholds also are increased (to $1,000,000 for joint filers and $500,000 for all other taxpayers). Many taxpayers who are subject to AMT under pre-Act law will not be subject to AMT under the Act because of the Act’s treatment of many itemized deductions (see below).

Limitation on Business Losses for Individuals

Individuals (and other noncorporate taxpayers including trusts and estates) may no longer deduct “excess business losses.” Generally, a taxpayer will have an excess business loss for a tax year if the taxpayer’s deductible items from trades or businesses exceed the sum of (i) the taxpayer’s aggregate business income and gains and (ii) a threshold amount ($500,000 for taxpayers filing joint returns; $250,000 for other taxpayers). If a taxpayer has an excess business loss, the taxpayer must carry that loss forward to subsequent tax years in the same manner as a net operating loss (“NOL”). NOL carryovers generally are allowed for a tax year up to 80% of taxable income without regard to the deduction for NOLs. This provision applies after the application of the passive loss rules. In the case of a partnership or S corporation, the excess business loss limitation applies at the partner or shareholder level.

Repeal or Suspension of Certain “Above-the-Line” Deductions

Alimony and Separate Maintenance Payments

Effective for divorce or separation instruments entered into after December 31, 2018, alimony and separate maintenance payments are neither deductible by the payor spouse nor includible in the payee spouse’s income. Divorce or separation instruments entered into on or before December 31, 2018 generally are not covered by this new rule, unless the instruments are modified after that date and expressly provide that the new rule applies.

Moving Expenses

The Act eliminates the deduction for moving expenses related to most taxpayers’ job changes (the deduction remains for members of the U.S. military under certain circumstances). In addition, qualified moving expense reimbursements that previously were excluded from an employee’s gross income now will be treated as income.

Student Loan Interest and Qualified Tuition and Related Expenses: Not Affected

While the original House bill had proposed changes, the Act preserves deductions for certain student loan interest, qualified tuition and related expenses, and does not treat tuition reductions as taxable income.

Certain Itemized Deductions Eliminated or Limited

State and Local Taxes

The Act limits the deduction for state and local income tax (or sales tax in lieu of income tax) and property tax to $10,000 ($5,000 for married filing separately). This will significantly affect many taxpayers who reside in high-tax jurisdictions such as New York, New Jersey, and California. Deductions for state and local taxes are not subject to the cap in computing business income and investment income (such as income from a rental property).

Planning tip: Taxpayers should consider paying, by December 31, 2017, (i) any 2017 state and local income taxes that they expect to owe (including 4th quarter estimated income taxes that are due in January), and (ii) 2018 local property taxes (at least the first two quarters). In addition, taxpayers should consider settling any ongoing state and local income tax audit (and paying any amount owed) before year end, and paying any past due state and local income tax liability. That’s because the $10,000 limitation on deducting state and local taxes does not apply for the 2017 tax year.

Caveat: Individuals should check with their tax preparers to see whether they will be subject to the AMT in 2017, as that may impact the potential benefit of paying taxes before December 31. In addition, the Act disallows any 2017 deduction for 2018 state and local income taxes paid by December 31, so prepaying next year’s income taxes will not produce any federal income tax benefit in 2017.

Home Mortgage Interest

Under the Act, a taxpayer may deduct interest paid on up to $750,000 of debt ($375,000 for married individuals filing separately) used to acquire, construct, or substantially improve the taxpayer’s qualified residence (“acquisition indebtedness”). Individuals may continue to deduct interest paid on up to $1,000,000 ($500,000 for married individuals filing separately) of acquisition indebtedness incurred before December 15, 2017. Special rules apply to taxpayers who entered into binding contracts before December 15, 2017 to purchase a principal residence but who close after December 31, 2017. The Act also eliminates the deduction for interest on home equity loans, regardless of when the home equity loan was originated.

Charitable Contribution Deductions

Several changes are being made to the rules governing charitable contributions. First, the percentage limitation on deductions for cash contributions to public charities and certain private foundations is increased from 50% of a donor’s adjusted gross income to 60% of the donor’s adjusted gross income. Second, no portion of the amount paid for the right to purchase tickets to a college athletic event will be deductible. Third, donors will be required to obtain and provide a contemporaneous written acknowledgement for all contributions over $250, regardless of whether the done organization reports that contribution on its return.

Planning tip: An individual who anticipates not itemizing deductions in 2018 but itemizing deductions in 2017 should consider accelerating charitable contributions into 2017.

Medical Expenses

The Act retains the deduction for medical expenses and decreases the “floor” for the medical expense deduction to 7.5% of a taxpayer’s AGI for 2017 and 2018. That 7.5% threshold applies for purposes of calculating AMT for these two years. After 2018, the floor is scheduled to revert to 10%.

Certain Miscellaneous Deductions Subject to the 2% Floor

The Act eliminates all miscellaneous itemized deductions for expenses that previously were subject to the 2% floor. Notable examples include expenses for the production or collection of income (such as investment fees), tax preparation expenses, and unreimbursed employee expenses (such as work-related education expenses).

This Alert provides only a simple overview of complex and nuanced tax provisions. Given the fluid fiscal and legislative environment, there may be additional changes coming. To learn more about the Act and its implications for you or your business, please contact one of the Lowenstein Sandler attorneys listed.

For more information about other provisions of the Act, please see the links below:

KEY CORPORATE & BUSINESS TAX PROVISIONS

KEY PARTNERSHIP TAX PROVISIONS

KEY FOREIGN TAX PROVISIONS

KEY TAX-EXEMPT ORGANIZATION TAX PROVISIONS

KEY TRUST & ESTATE TAX PROVISIONS

KEY TAX PROVISIONS AFFECTING HEDGE FUNDS, PRIVATE EQUITY FUNDS AND OTHER INVESTMENT VEHICLES